nj property tax relief 2018

Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent. There will be no property tax relief in New Jersey as long as the current politicians are in control currently the Democrats.

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

High property taxes have long plagued our state with homeowners paying the price in more ways than just the bill that shows up in the mail.

. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home. 150000 or less for homeowners age 65 or over or blind or disabled. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes.

New Jersey just increased funding for a key state property-tax relief program and this month homeowners across the state are getting their first opportunity to apply for those beefed-up tax breaks. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and. On January 1 2018 and after the tax rate will decrease to 6625.

Eligibility requirements including income limits and benefits available under this program are subject to. Senior Freeze Property Tax Reimbursement Program. You are eligible for a property tax deduction or a property tax credit only if.

On January 1 2017 the tax rate decreased from 7 to 6875. COVID-19 is still active. The Homestead Benefit program provides property tax relief to eligible homeowners.

If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. Homeowners Verification of 2018 and 2019 Property Taxes For use with Form PTR-1 Keywords. 75000 or less for homeowners under age 65 and not blind or disabled.

Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. NJ Division of Taxation - Local Property Tax Relief Programs. Stay up to date on vaccine information.

The program was restored in the approved budget that went into effect on October 1 2020. Additional information on the Sales and Use Tax changes is available online. 3 rows Certain seniordisabled homeowners who were not required to file a 2018 New Jersey Income Tax.

One of New Jerseys top property tax relief. The State of New Jersey has provided a web page for residents to access information about property tax relief. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did.

Earlier this month Christie signed into law a 347 billion budget for the 2018 fiscal year that included 200 million for the senior-freeze program. New Jersey Gov. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on.

New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. When Did You Send Your Application. Between May 2.

The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018. Property Tax Relief Programs Homestead Benefit. Nj property tax relief 2018 Thursday March 17 2022 Edit.

All property tax relief program information provided here is based on current law and is subject to change. Its a Sad Reality. Forms are sent out by the State in late Februaryearly March.

For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and. Call NJPIES Call Center.

Check Issued on or Before. You will need the assigned Identification Number and PIN of. Thousands of New Jersey homeowners have begun receiving applications from the state Department of.

However the total of all property tax relief benefits that you receive for 2018 Senior Freeze Homestead Benefit Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the amount of your 2018 property taxes or rentsite fees constituting property taxes. 3 rows If your 2018 New Jersey Gross Income is. Nows the time to apply for bigger Homestead relief benefits.

And checks averaging 219 for 25100 expected. Before May 1 2018. Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. October 31 2018 Reimbursement Checks. And Murphys budget for the fiscal year that begins July 1 doesnt include enough cash.

You met the 2018 income requirements. To qualify you must meet all the eligibility requirements for each year from the base. Thats projected to be enough money to cover reimbursement checks averaging 1401 for an estimated 138200 existing senior-freeze recipients.

The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability. NJ Division of Taxation - Property Tax Relief Forms. Qualified homeowners and tenants are eligible for a deduction for property taxes they paid for the calendar year on their New Jersey principal residence.

Credit on Property Tax Bill. Homeowners Verification of 2018 and 2019 Property Taxes For use with Form PTR-1 Author. Property Tax Relief Programs.

The filing deadline for the latest application which is for tax year 2018 is Nov. There will be no property tax relief in New Jersey as long as the public unions and special interests control these. Have a copy of your application available when you call.

The awful property tax tentacles reach far and wide. Nj Property Tax Relief Program Updates Access Wealth Township Of Nutley New Jersey Property Tax Calculator Pin On From Our Blog How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com. As of April 2018 this is the summary of our findings from the past 2 years.

Property taxes for 2018 were paid on that home. If you were not a homeowner on October 1 2018 you are not eligible for a Homestead Benefit even if you owned a home for part of the year. The new law enacted in July 2018 increases the maximum Property Tax Deduction from 10000 to.

All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. NJ Division of Taxation Subject.

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A Great Selling House Just A Reminder Reminder

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting

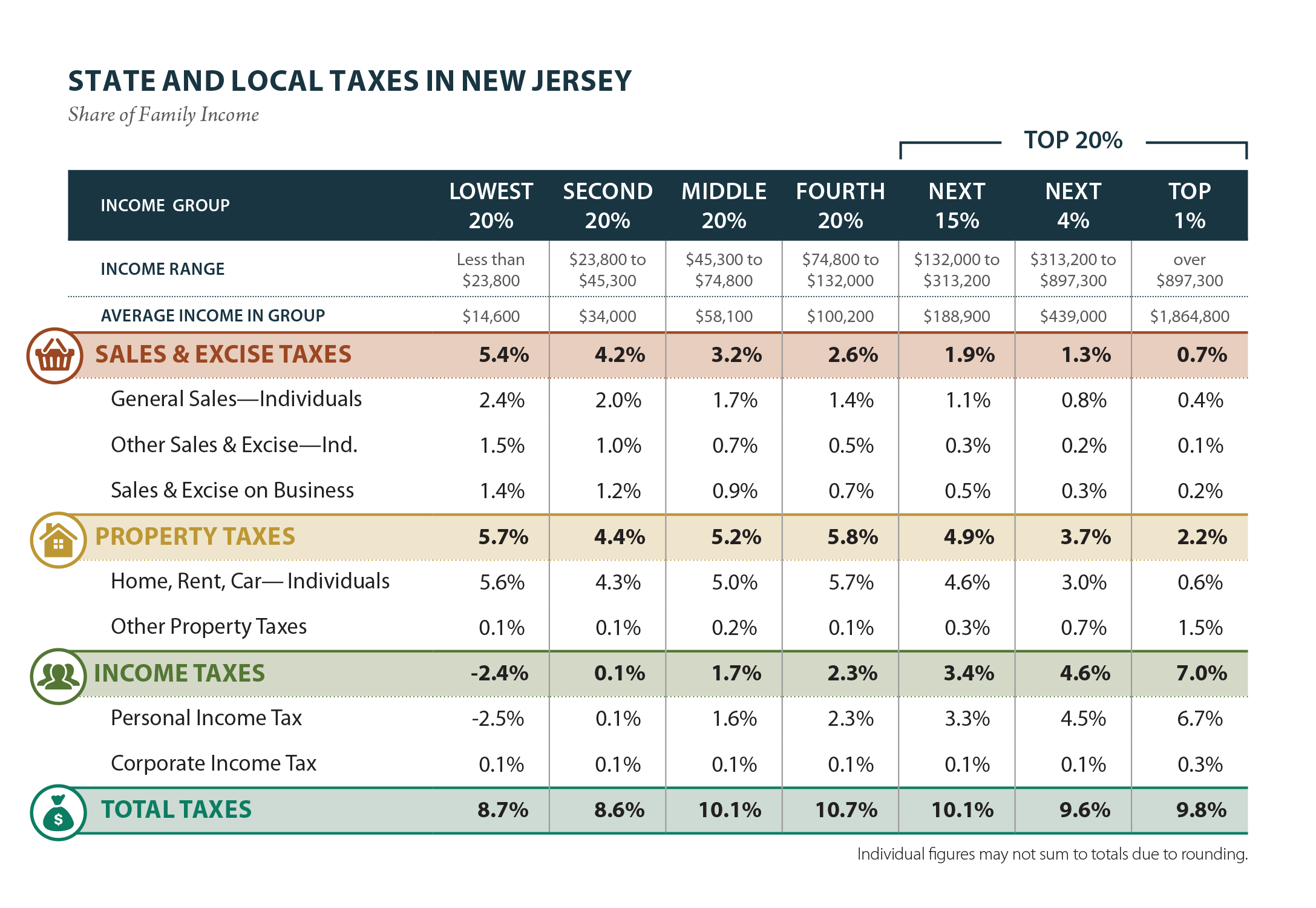

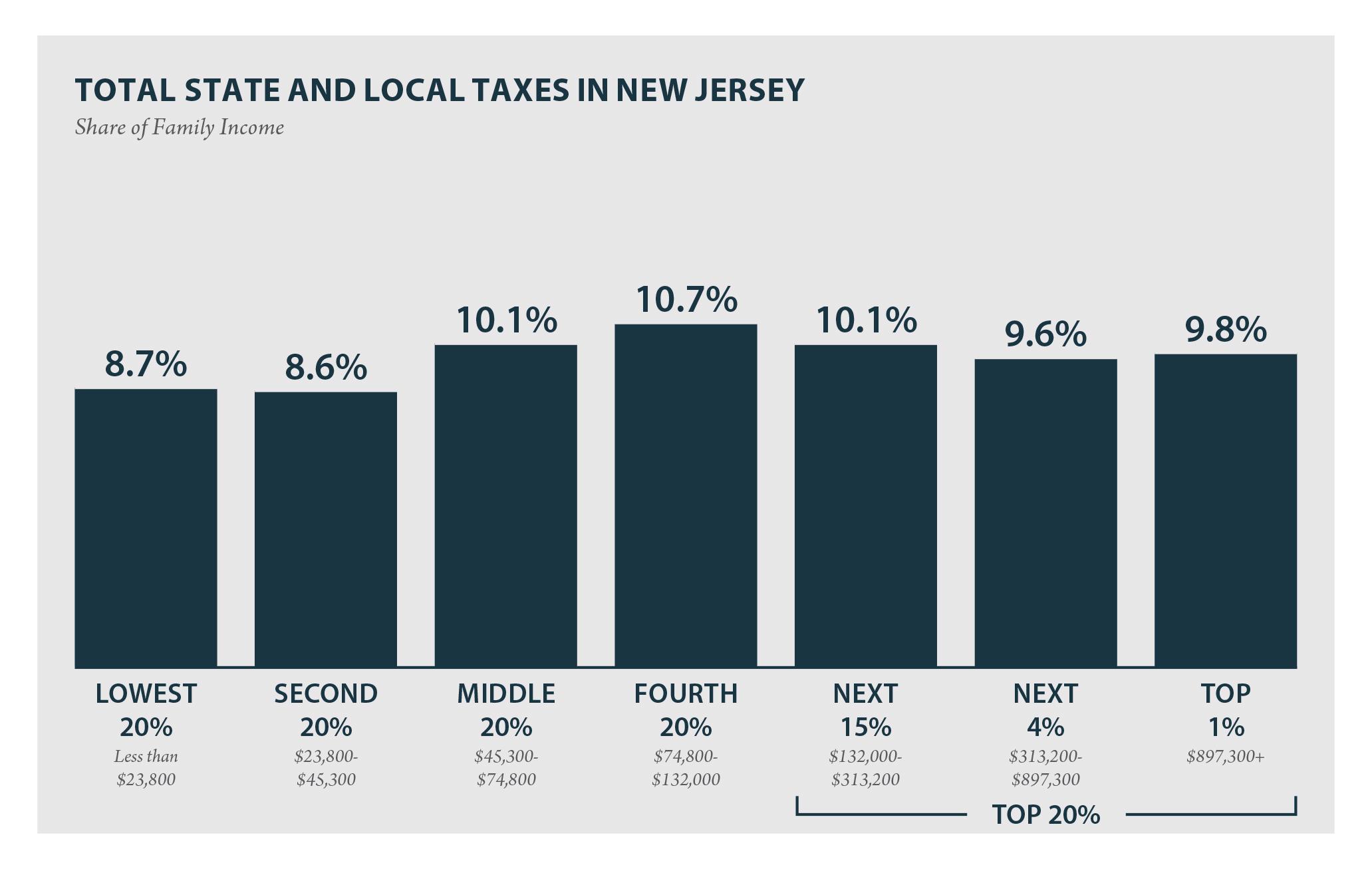

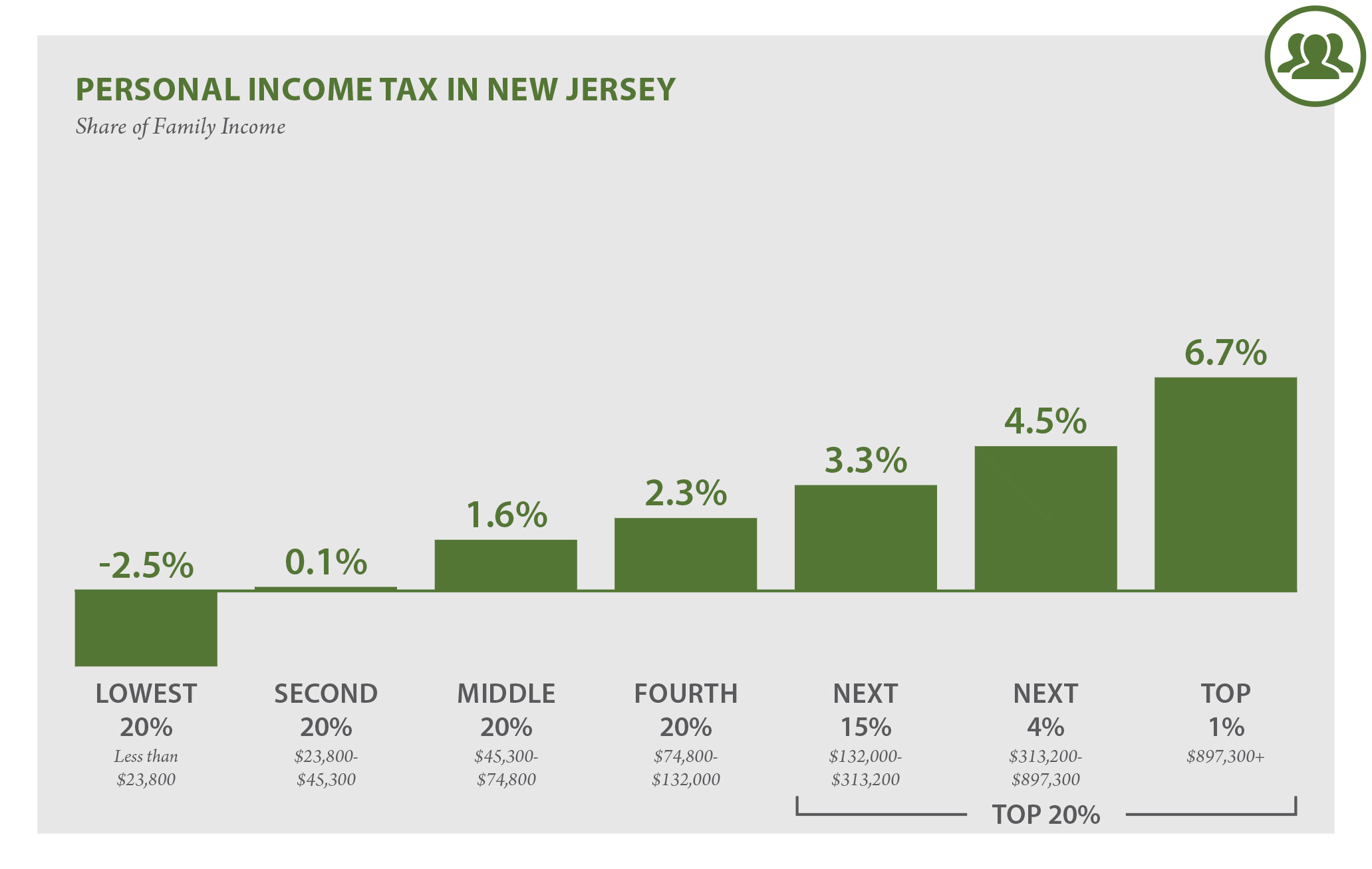

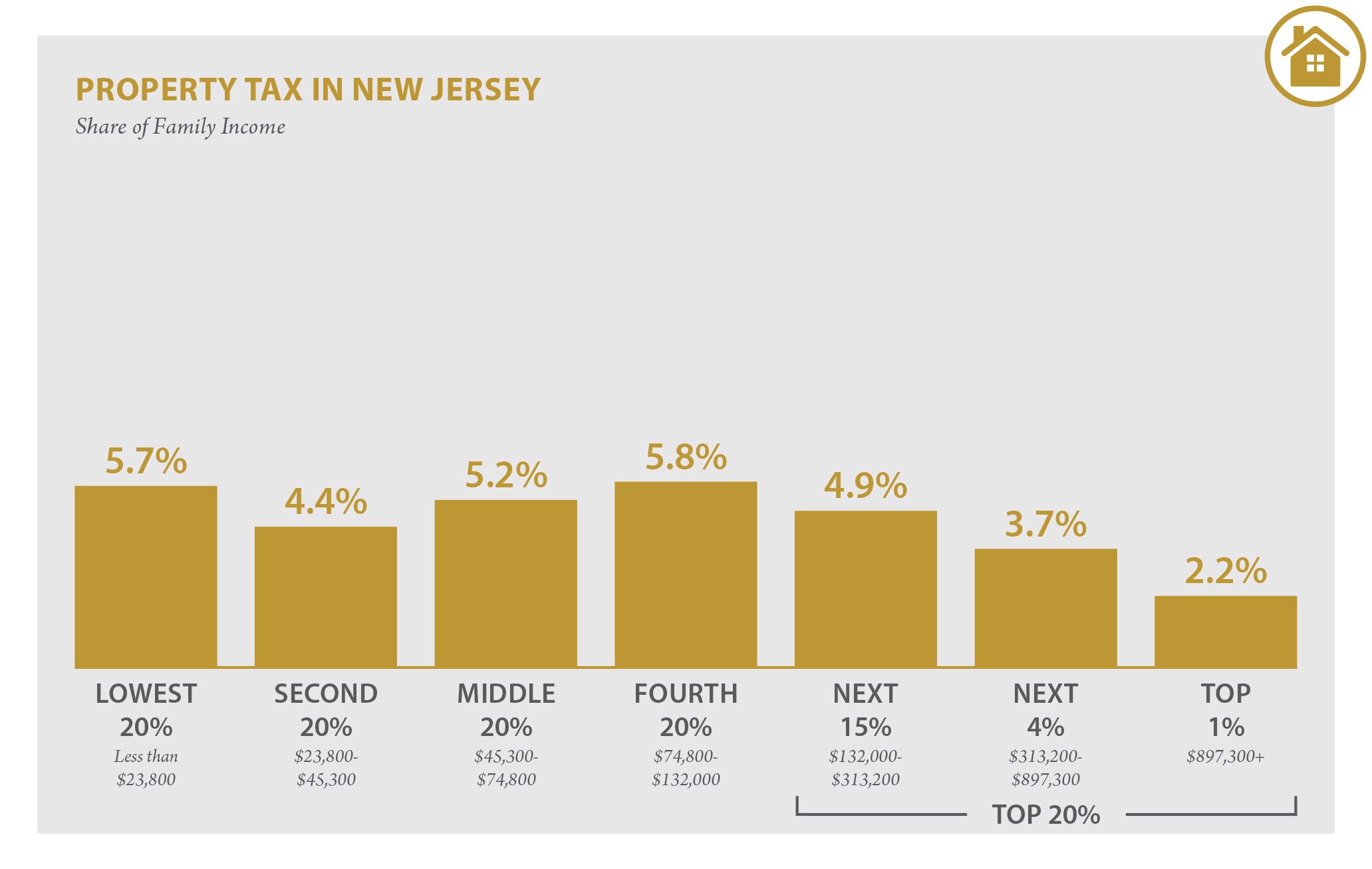

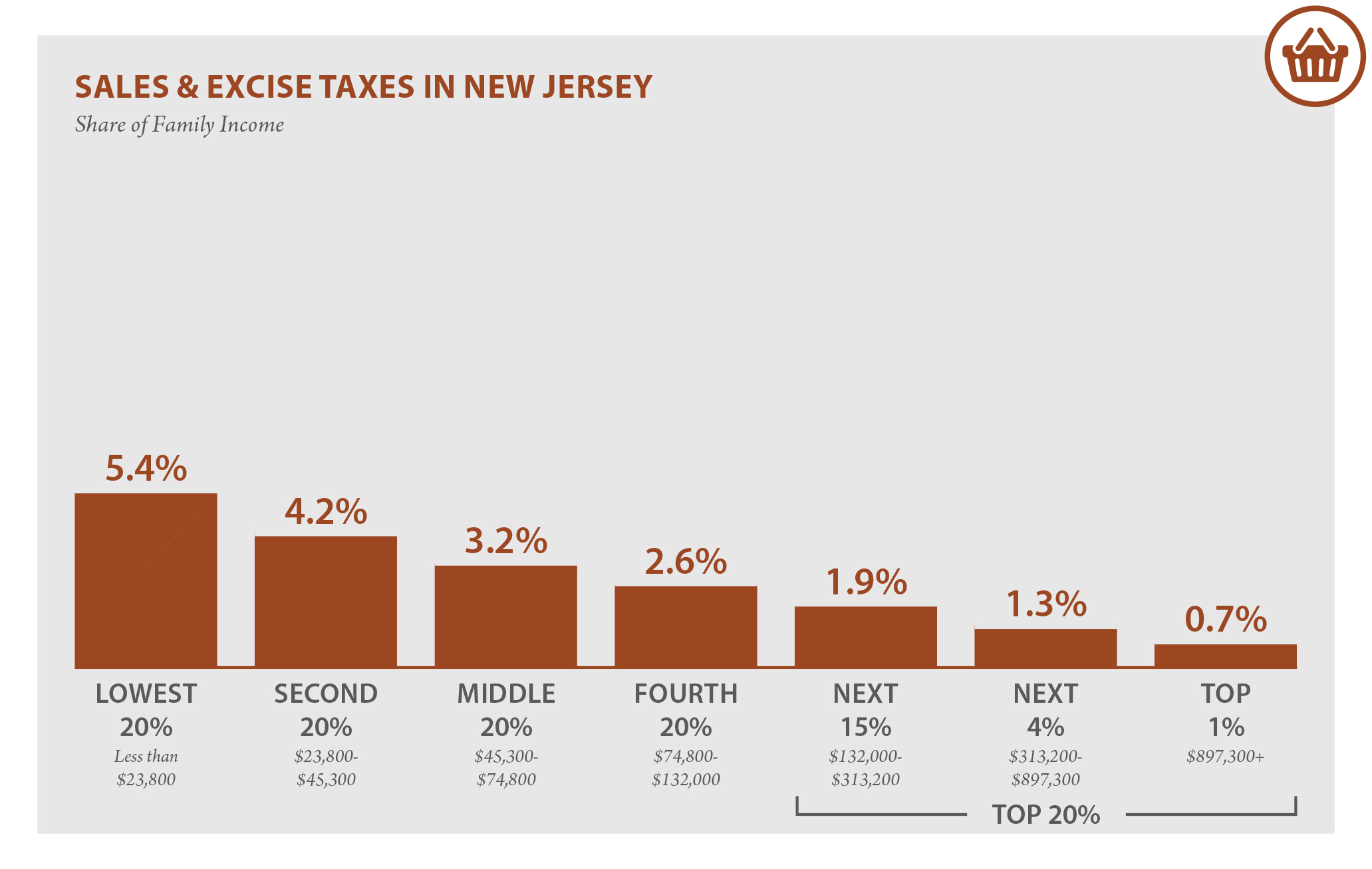

New Jersey Who Pays 6th Edition Itep

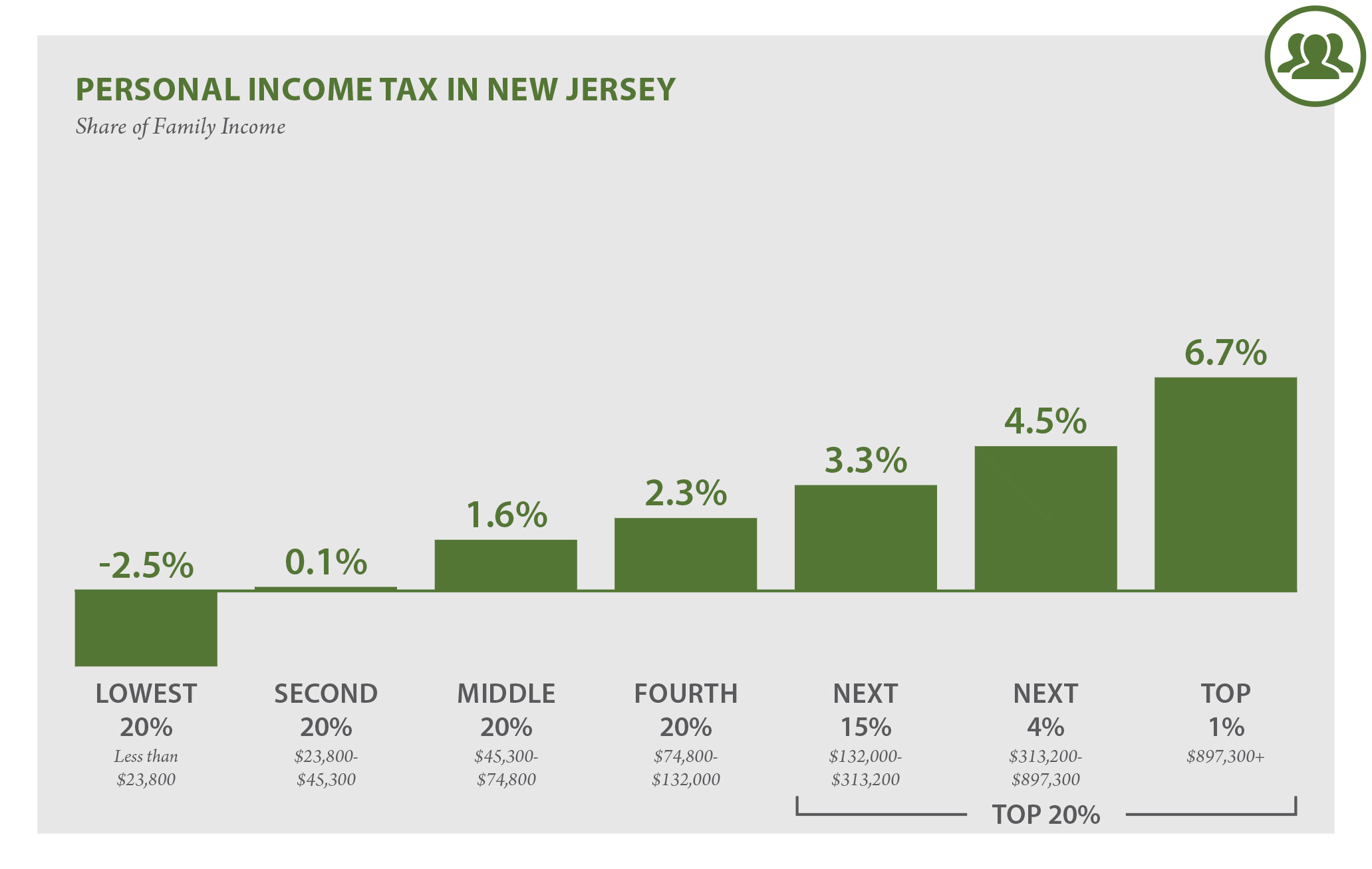

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Who Pays 6th Edition Itep

New Jersey Who Pays 6th Edition Itep

The Top Ten Events In Somerset County Nj This Weekend March 30 April 1 2018 Joe Peters Somerset County Somerset County

Township Of Nutley New Jersey Property Tax Calculator

New Jersey Who Pays 6th Edition Itep

New Jersey Who Pays 6th Edition Itep

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Township Of Nutley New Jersey Property Tax Calculator

Where S My New Jersey State Tax Refund Taxact Blog

Nj Property Tax Relief Program Updates Access Wealth

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective